The documentation required depends on whether the policy is owned (either jointly or solely) by another person, or was owned solely by the deceased.

If the policy is owned jointly or solely by another person (such as the partner of the deceased), then the documentation required is as follows:

- The original policy document, or a completed Lost or Destroyed Policy Document Form PDF.

- An original or certified copy of either the deceased’s birth certificate or passport.

- An original or certified copy of the death certificate.

The death certificate must state the cause of death. If the cause of death is “Subject to Coroner’s Findings”, then it is an interim one which is issued prior to a coroner’s inquiry. In that circumstance the confirmed cause of death will be contained in the coroner’s report which is issued after the inquiry. As the cause of death must be confirmed, you need to provide the coroner’s report (or a certified copy) for the claim to be assessed.

If the policy was owned solely by the deceased, then you also need to supply the original (or a certified copy) of either:

- Probate, or

- Letters of Administration.

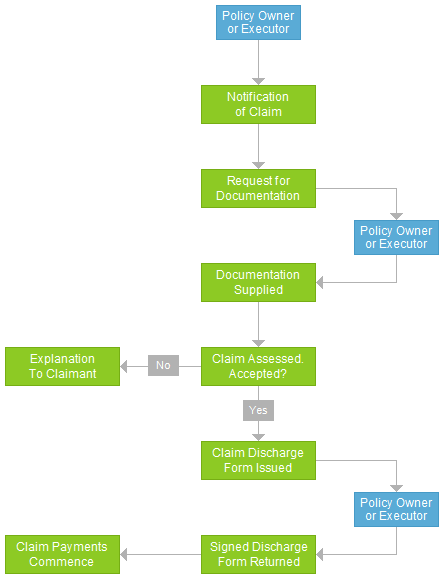

The claim is assessed when all required documents have been provided (a process which normally takes only a day or two). On acceptance of the claim, a Claim Discharge Form is prepared and sent to the policy owner, or the executor of the will, as applicable. Monthly benefit payments, which are direct-credited to the bank account nominated on the form, commence after receipt of the signed Claim Discharge Form.

Claims Process

The entire claims process can be illustrated as follows: