What is Income Protection Insurance?

Income protection insurance is a policy which pays a monthly benefit if you are disabled due to illness or injury and, as a result, you are unable to work in your own occupation.

The benefit starts after a waiting period which you choose and is payable for a maximum period which you choose. The benefit is reduced by the amount of any other income replacement or mortgage protection benefit which you receive or are entitled to receive, such as ACC payments.

AIA Living Income Protection

Income Protection provides you with an income to enable you to meet your commitments and your living expenses, and for the upkeep of any dependants you might have. It provides a source of income designed to last well after standard sick leave entitlements have been exhausted.

Most people are able claim a tax deduction each year for their income protection insurance premiums, therefore the net cost is up to 39% lower than the actual premiums paid.

| Minimum commencement age | 16 |

| Maximum commencement age | 55 (60 for certain occupations) |

| Expiry age | 65 |

| Benefit type | Indemnity |

| Maximum cover | 75% of your annual earnings before tax |

Learn More

Benefits

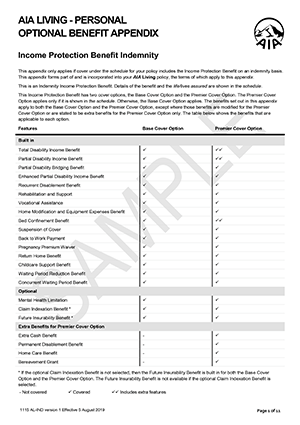

Income Protection includes a comprehensive range of benefits:

Income Protection BenefitReceive a monthly benefit if you are totally disabled and unable to work in your own occupation due to illness or injury. Receive a partial benefit if you are unable to work for more than 75% of your average weekly pre-disability hours or earn less than 75% of your pre-disability income. Any partial disability benefit that you receive will be enhanced by up to 25%, payable for up to 12 months, if you have previously received a total disability benefit under the policy. |

|

Recurrent Disablement BenefitYour waiting period will be waived if you become disabled again from the same or a related cause within 12 months of your disability benefit payments ceasing. |

|

Rehabilitation and SupportOne of AIA’s dedicated case managers will work with you to understand your personal situation and will consider what assistance could aid your return to work or improve your capacity to work. |

|

Vocational AssistanceAIA may agree to pay for vocational assistance of up to 12 times your monthly total disability benefit if you’re unlikely to return to your pre-disability occupation. |

|

Home Modification or Equipment Expenses BenefitAIA may agree to pay you an additional lump sum payment of up to 12 times the monthly benefit amount to cover the costs of buying specialised equipment or completing home alterations that have become necessary due to your total disability. |

|

Bed Confinement BenefitIf, at any time during the waiting period, you are confined to bed under full-time care for more than three days, then AIA will pay a Bed Confinement Benefit for each complete 24-hour period after the first 72 hours of bed confinement. |

|

Home Care BenefitProvides an additional benefit payment for the services of a carer for up to 6 months if you are totally disabled. This benefit is paid in arrears to the person providing the care. |

|

Back to Work PaymentIf your benefit payment period is greater than two years, AIA will pay you a Back to Work Payment of up to 3 times your monthly benefit amount if you return to work between 12 and 24 months after claiming receiving a total or partial disability benefit. |

|

Pregnancy Premium WaiverIf you become pregnant and are on maternity leave, AIA will waive the premium for the Income Protection Benefit for six consecutive months at any stage between the second trimester and six months after your pregnancy ends. This benefit is only available if you become pregnant at least 9 months after the commencement date of the policy. |

|

Return Home BenefitIf you suffer total disability while outside New Zealand, AIA will pay for a single standard economy flight back to New Zealand for you and a support person (Maximum amounts apply). |

|

Childcare Support BenefitAIA will pay a Childcare Support Benefit if you are receiving Income Protection Benefit payments and, as a direct result of your disability, additional childcare costs are incurred for any child under the age of 14 that are over and above any childcare arrangements which existed prior to you becoming disabled. |

|

Future Insurability BenefitIncrease your Income Protection Benefit by up to 10% (subject to a maximum increase of $12,000) every three years without the need to provide further medical evidence. |

|

Suspension of Cover BenefitFlexibility to suspend your cover for up to 12 months if you:

No premium will be payable during the period that cover is suspended. No claim will be payable during, or for any disability that occurs during, the period that cover is suspended. |

Please refer to the Policy Wording for full details of all benefits and any associated terms and conditions.

Waiver of Premium Benefit

The Waiver of Premium benefit is mandatory when you select Income Protection.

If you are unable to work due to total disability, your premium payments will be waived while your insurance remains in place.

| Expiry age | 65 |

To learn more about the Waiver of Premium Benefit, please see the Policy Wording.

Optional Redundancy Cover

You can choose to add the optional Redundancy benefit to your Income Protection benefit.

- If you are made redundant within the first 6 months of the policy or benefit commencing, no Redundancy Benefit will be paid;

- The Redundancy Benefit has a waiting period of 4 weeks from the date of redundancy until benefit payments commence (the waiting period may be longer than 4 weeks if your employer makes a redundancy payment); and

- A Redundancy Benefit is payable for a maximum period of 6 months.

| Expiry age | 65 |

| Benefit type | Agreed Value |

| Maximum cover |

$48,000 per annum ($4,000 per month)

Cannot exceed the amount of Income Protection cover |

To learn more about the Redundancy benefit, please see the Policy Wording.

Policy Features

Income Protection insurance includes the following features:

Financial StrengthThe policy is underwritten by AIA New Zealand Limited, New Zealand’s largest life insurer. AIA New Zealand Limited has an AA (Very Strong) financial strength rating from Fitch Ratings. |

|

24 x 7 Worldwide CoverWhether you’re at home, travelling or working anywhere for any period (including overseas, even if you move overseas permanently), you remain insured. |

|

Automatic EnhancementIf any change is made to the underlying AIA Living policy in the future, and that change would be favourable to you, then the Enhancement Pass Back Benefit means that the enhanced change will automatically be applied (passed back) to your policy. Conditions apply. |

|

Free-Look PeriodIf at any time during the 15 days following receipt of your policy you do not wish to continue with your cover (for whatever reason at all), you can return your policy for a full refund of all premiums paid. |

Please refer to the Policy Wording for full details and any associated terms and conditions.

Brochure

Download or view the brochure:

Policy Wording

The Income Protection policy wording is comprised of the following documents:

AIA Living Umbrella Policy Wording PDF

The Umbrella Wording is common to all AIA Living policies.

Income Protection Indemnity Policy Wording PDF

This Benefit Appendix is specific to the Income Protection benefit.

Waiver of Premium Policy Wording PDF

This Benefit Appendix is specific to the Waiver of Premium benefit.

Redundancy Policy Wording PDF

This Benefit Appendix is specific to the optional Redundancy benefit.

AIA Vitality

AIA Vitality is a science-backed health and wellbeing program that supports and rewards you for making healthier choices.

Premiums for eligible insurance policies that cover you may be discounted in certain circumstances based on your membership and participation in the AIA Vitality program. You will receive an initial 10% premium discount in your first year.

A membership fee of $11.50 per month per member applies.

FAQs

Check out our FAQs for answers to frequently asked questions.

Get a Quote ›Important Information

- The above identifies and provides a brief summary only of the principal benefits under the policy. Please refer to the Policy Wording for full details of all benefits and the terms and conditions under which they are provided. Cover is subject to underwriting and approval by AIA.